Optimize Digital Payments Across Borders

Here’s what payment fintech professionals need to realize and how payment orchestration can benefit you. Discover why the next series of fintech transformation is guided by vendors and merchants that are integrating fintech into applications.

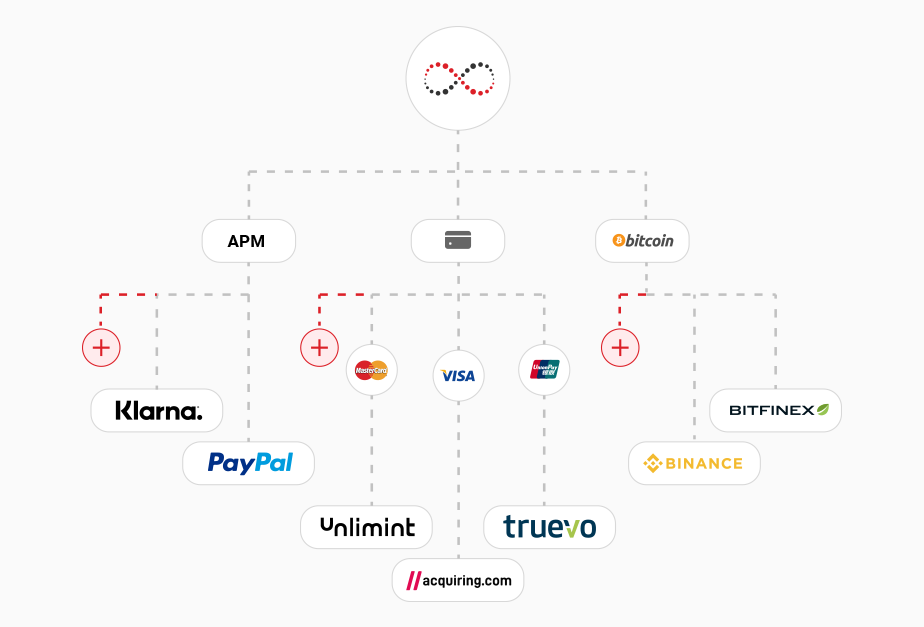

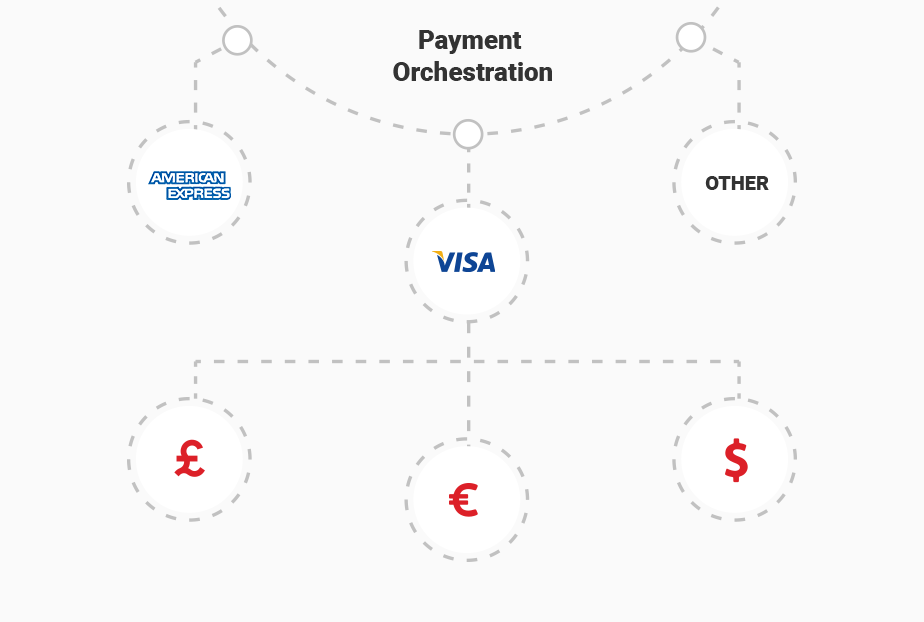

Payment Orchestration Platforms (POPs) provide a single technical structure that initiates, directs and validates all transactions between merchants, customers and payment providers. Payment orchestration covers every step of the payments process from routing through to reconciliation.

Why are Businesses Embracing Payment Orchestration?

Merchants with global expansion goals need to optimize their operations to scale by entering new markets and regions. They also need to grow existing customer bases and create great customer experiences, by introducing innovative processes.

The right payment infrastructure for different markets makes this possible. However, the merchants need to offer localized payment systems to their customers, conform to local rules and regulations, and offer safe, reliable and efficient payment acceptance flows.

For this, global merchants integrate with multiple region-specific payment service providers (PSPs). These integrations often involve a high level of maintenance to manage a range of complex payment gateways, payment stacks, and payment integrations.

This is where payment orchestration does its job.

What are the Advantages and Capabilities of Payment Orchestration?

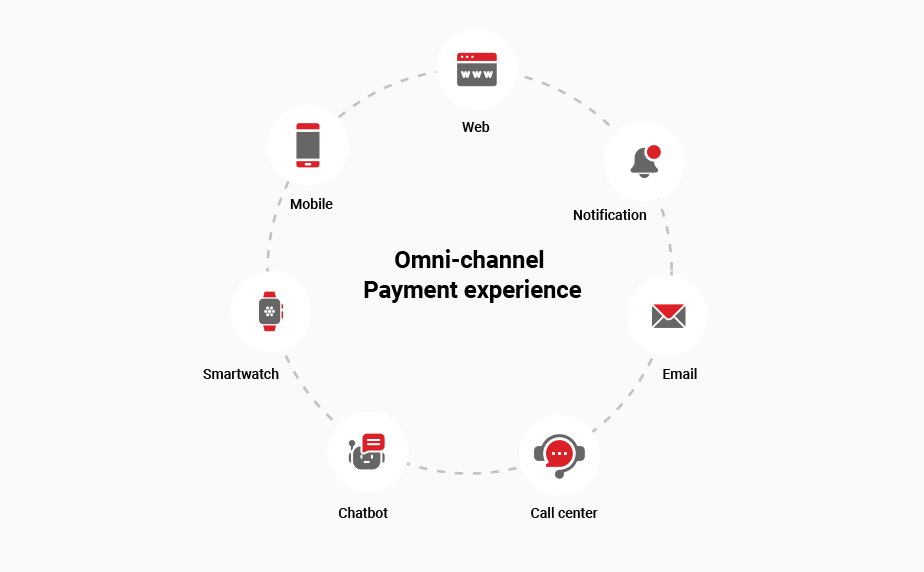

An orchestration platform helps merchants realize optimized payments flow at the least cost. A key benefit is the ability for smart routing, so transactions are routed to the best performing provider. This can help merchants improve conversion rates. It eliminates payment friction across all digital channels. Payment orchestration also provides merchants with the resilience to withstand and adapt to any market changes – such as swift consumer payment inclination changes, or new payments technology.

How does a Payments Orchestration Layer Work?

The objective of any payment solution is a simple one: maximise conversion rates and limit costs whilst making life as easy as possible for our merchants and their customers. This can be accomplished by integrating the optimum providers globally through a single provider that will continue to audit your set-up to futureproof your payments stack.

IPEX Works With Industry Leaders in Payment Orchestration

There are many companies providing payment orchestration platforms. IPEX works with the industry leaders:

Spreedly

- Access 120+ gateways around the world

- Capture, store and tokenize payment methods

- Transaction reports – Get rich payments insights

Paydock

- Unlimited connections – specialised, PCI-DSS compliant SDK widget

- Recurring payments – sophisticated recurring payments engine which drives automated, recurring payments with infinite flexibility

- Multi-role, multi-user permissions (and API)

The IPEX Advantage

- Offering a tailored payment experience for international shoppers

- Meeting global customers’ demand for availability of their preferred payment methods

- Offering just the right mix of payment solutions

- Eliminate risk of ending up with a disintegrated, fractured payment setup while building payment connections in-house

Many Services, One Unified Experience

Trusted By Great Companies